https://doi.org/10.5281/zenodo.18593780

Water and Climate Leader @ Green Climate Fund | Strategic Investment Partnerships and Co-Investments| Professor| EW4ALL| Board Member| Chair- CODATA TG

February 5, 2026

Climate-related hazards are increasing in frequency and severity, threatening decades of development gains. Last year alone, extreme floods, storms, and droughts caused hundreds of billions in economic losses worldwide and hit the poorest communities hardest. For developing countries, these hazards can reverse progress on poverty reduction and shared prosperity overnight. That’s why building financial resilience to disasters is as critical as building physical resilience. We must equip countries with innovative financial tools to absorb and recover from shocks, shifting from reactive crisis response to proactive risk management.

Innovative financial instruments and strategies are helping de-risk markets and unlock funds for disaster preparedness. At Green Climate Fund, we provide an innovative fit-for-purpose blended finance approach to climate and disaster risks. In GCF-backed programs, we often combine grants, low-interest concessional loans, guarantees, and even equity investments to make resilience projects financially viable. Each instrument plays a role: grants can cover upfront design and capacity-building costs; concessional loans provide affordable capital for infrastructure like early warning systems; guarantees lower the risk for other investors by ensuring debt repayment; and equity stakes or first-loss capital from development partners can absorb initial losses, making projects attractive to private co-investors. Increasingly, we also include insurance and risk transfer tools for example, parametric insurance contracts that pay out quickly after a disaster based on trigger parameters, or catastrophe bonds that tap global capital markets. By blending these instruments, countries effectively reduce the risk and cost for private-sector partners, thereby crowding in their participation. In a recent multi-country climate resilience initiative, for instance, our concept design explicitly noted how fiscal constraints and limited private appetite justify using grants, concessional loans, and guarantees together to close the affordability gap that pure market funding would leave. Innovative finance acts as a bridge between public goals and private capital: public and climate funds take on a portion of the risk or provide sweetened terms, so that early warning systems (EWS), resilient infrastructure, and disaster risk reduction (DRR) projects become bankable. This approach helps overcome the typical barriers – high up-front costs, long payback periods, uncertain revenue that normally deter investment in preventive resilience. Indeed, we’re already seeing that concessional climate funding, combined with private capital, is being used to de-risk projects and attract insurance solutions, thereby maintaining affordability for countries while enabling commercial investment.

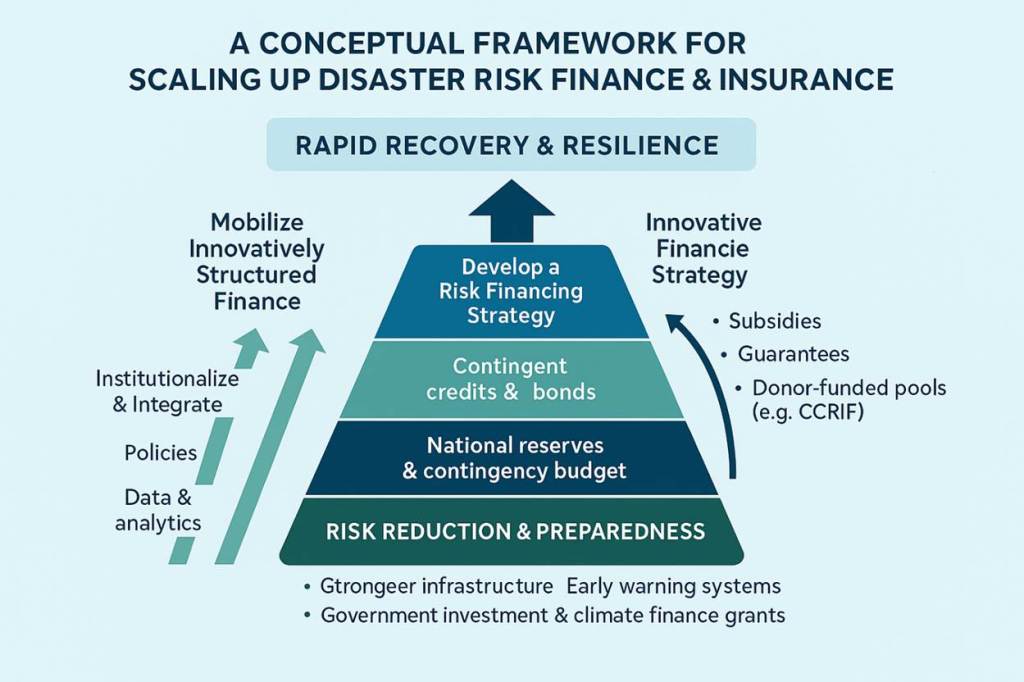

Historically, early warning and preparedness have been underfunded, relying on donor grants or government budgets. But now, by packaging early-warning improvements with financial instruments, we can attract new resources. For example, consider forecast-based financing using a bond, where predictive weather data triggers funding releases before a disaster hits. With parametric insurance (whose payouts are tied to triggers such as cyclone wind speed or rainfall levels), we can ensure that, when an extreme event is forecast or occurs, immediate liquidity is available for early action without waiting for lengthy relief appeals. In practice, this might mean a country’s disaster agency has an insurance policy that pays, say, $5 million as soon as a Category 4 or higher hurricane is detected, enabling rapid evacuation and shelter setup. By integrating such insurance with early warning protocols, countries turn warnings into automatic, funded action plans. Crucially, innovative finance can also support disaster risk reduction investments that lower insurance costs over time. If a developing country invests in flood defences and resilient infrastructure (possibly with grant and soft-loan support), it reduces expected disaster losses, which in turn makes insuring the remaining risk cheaper. Thus, public DRR investment and private insurance can reinforce each other in a virtuous cycle: upfront risk reduction makes insurance more viable, and insurance payouts provide funds when needed to protect those investments and communities. Our aim is to help countries develop National Disaster Risk Finance Strategies that blend these elements – pre-arranged finance, insurance, and on-the-ground risk reduction – into a coherent framework. It’s about having the right money at the right time: a layer of contingency funds or rapid credit for high-frequency minor shocks, and insurance or cat bonds for the rare catastrophes, all while continuously investing in risk mitigation.

Good Practice:

Caribbean Parametric Insurance for Utilities: An excellent example of innovative disaster finance in action is in the Caribbean, a region highly vulnerable to hurricanes

Pacific Disaster Risk Financing and Catastrophe Insurance: Across the Pacific Islands, we see a similar story of innovation. PCRIC operates much like CCRIF, providing parametric climate and disaster insurance to member countries so that, when a severe cyclone or earthquake strikes, an insurance payout is triggered immediately to provide emergency funds.

Disaster risk finance and insurance are no longer experimental ideas; they are proven, essential tools for development in a volatile climate era. It attracts the private sector to stay engaged in risky markets (or even invest in them), because mechanisms are in place to handle the extreme shocks. It assures that governments can maintain essential services – keeping the lights on, the water running, and schools and hospitals open – even when nature strikes hard.

Fakhruddin, B. (SHM) . (2026). Empowering a resilient future through innovative climate financing. Zenodo. https://doi.org/10.5281/zenodo.18593780