Blended and concessional finance are essential to bridge the huge investment gap in water security and climate resilience. Public resources alone cover only a fraction of the multi‑trillion-dollar funding needed to ensure safe water and adapt to climate change. In Asia and the Pacific, for example, less than 40% of the $250 billion needed annually for water and sanitation is being met, leaving a shortfall over $150 billion. Private capital currently makes up <1% of water infrastructure financing, largely because water projects often have low returns and high perceived risk. Blended finance – which strategically combines public or donor funds with commercial investment – directly tackles this problem. Concessional loans, guarantees, and grants de-risk projects and improve their bankability, mobilizing far more private money than governments or aid could alone. In short, without these financing tools, most countries cannot scale up safe water access or climate adaptation fast enough to protect communities.

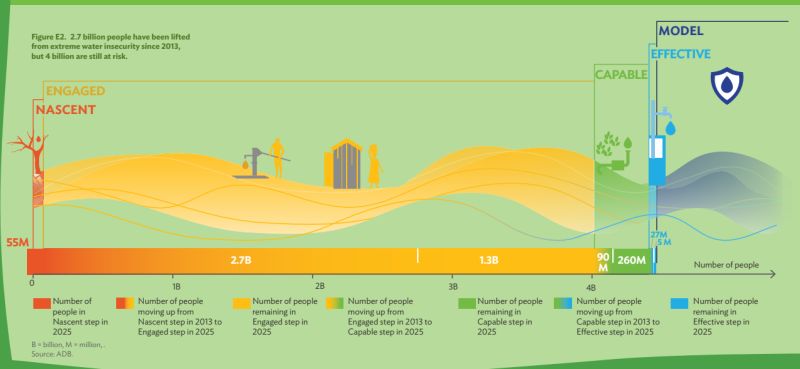

Leading analyses emphasize that such financing approaches are critical going forward. The Asian Water Development Outlook 2025 report, for instance, warns that hard-won gains in water access are now at risk from rising climate threats and funding shortfalls. It explicitly calls for “deploying innovative finance”, especially blended public–private funding as a pillar of delivering long-term water security. In other words, without scaled-up concessional and blended finance, billions of people could slip back into water insecurity as climate pressures mount.

Read the Asian Water Development Outlook 2025 (#AWDO) for deeper insights on how innovative finance is accelerating progress https://lnkd.in/gcvWcF9Q

#BlendedFinance #ConcessionalFinance #WaterSecurity #ClimateResilience #InnovativeFinance #AWDO #ClimateAdaptation #SustainableDevelopment #PublicPrivatePartnerships #AsiaPacific