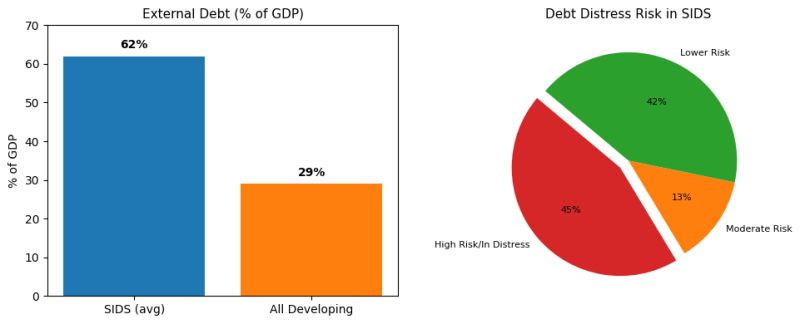

#SIDS face severe debt vulnerabilities, with nearly half of SIDS (around 40–45%) already at high risk of debt distress or in debt distress, 13% at moderate risk, and only about 42% at low risk. These tiny economies carry disproportionately heavy debt burdens of government debt averages 57% of GDP in small states (about 10 percentage points above other developing economies). Repeated climate-related disasters drive much of this debt. For example, post-disaster borrowing accounted for 40% of #Tonga’s new debt from 2008–2023. Such shocks repeatedly force SIDS to take on expensive loans just to rebuild, trapping them in a cycle of debt. Climate change intensifies this cycle, as SIDS suffer more frequent and costly disasters (#Dominica lost 225% of GDP to one hurricane in 2017) and face existential threats like sea-level rise. Despite often having middle-income status, SIDS are far more structurally vulnerable about 35% more vulnerable than other developing countries on average a reality not reflected in standard financing criteria. This is why a “one-size-fits-all” approach by traditional finance institutions falls short. SIDS require highly concessional, flexible financing tailored to their unique climate and economic fragility, rather than market-rate loans based solely on income level.

The International Debt Report 2025 mentioned that half of low-income countries are now in or at high risk of debt distress (up from 24% in 2013 to 54% in 2024), with climate shocks a key driver. Several new financing opportunities are emerging to help high-risk SIDS manage or reduce debt while funding climate action. One promising avenue is debt-for-climate or debt-for-nature swaps, where a portion of a country’s debt is forgiven in exchange for investments in conservation or resilience. These swaps directly cut debt burdens and channel funds into climate priorities. Recent examples include Ecuador’s 2024 debt-for-nature swap, which bought back $1.5 billion of bonds for $1.0 billion (35 cents on the dollar), instantly slashing Ecuador’s external debt by $527 million while freeing hundreds of millions for Amazon rainforest protection.

For SIDS which are often middle-income yet as vulnerable as the poorest countries, leveraging vertical climate finance and innovative debt structuring is not just desirable but essential. It shields them from the “debt–disaster” trap, ensures that climate adaptation efforts are financed by grants or cheap loans rather than punitive debt, and aligns global climate action with debt sustainability. The experience of recent years from IDA’s scaled-up support to pioneering debt swaps provides compelling evidence and successful examples that should be expanded to fill the remaining financing gaps for SIDS facing high debt risks.

#DebtDistress #ClimateFinance #DebtForClimate #DebtForNature #ClimateAdaption #SustainableFinance #ClimateResilience #DebtManagement #SmallIslands #ClimateCrisis