Given the scale of need (the EW4All initiative estimates $3.1 billion needed by 2027 to cover global EWS gaps), public finance alone won’t suffice. So far, most EWS projects are grants in the public sector. A potential growth area is innovative financing for EWS and early action for example, we could expand support for parametric insurance linked to early warnings (one GCF-backed pilot in Georgia introduced weather-index insurance for flood-affected farmers), or public-private partnerships for last-mile telecom solutions. Unlocking private capital for EWS (e.g., working with telecom companies, insurance firms, and tech startups) remains challenging, but is an area where we could leverage its convening power and risk-taking ability. EWS could mean incentivising mobile operators, satellite companies, or hardware firms to extend services into high-risk regions in partnership with public agencies.

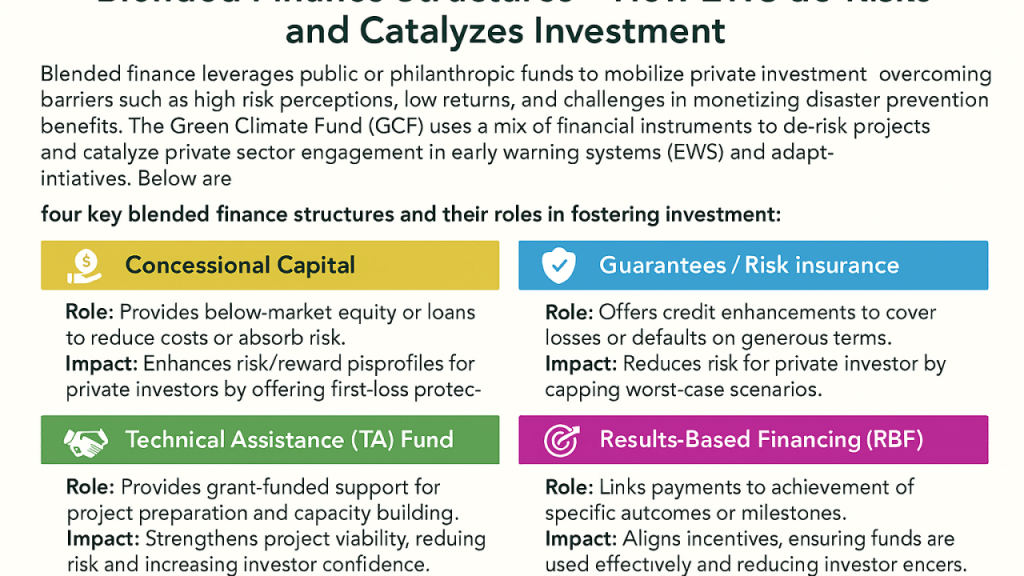

All these financing innovations use blended finance, combining grants or soft funds from public sources with private-sector financial instruments to reduce risk and ensure early warnings translate into early action. They represent a shift from pure grant dependency to sustainable financing models where private capital plays a role in protecting communities.

#EarlyWarningSystems #EW4All #DisasterRiskReduction #ClimateAdaptation #ClimateFinance #BlendedFinance #EarlyAction #ResilientCommunities #ParametricInsurance #PublicPrivatePartnerships #ClimateResilience