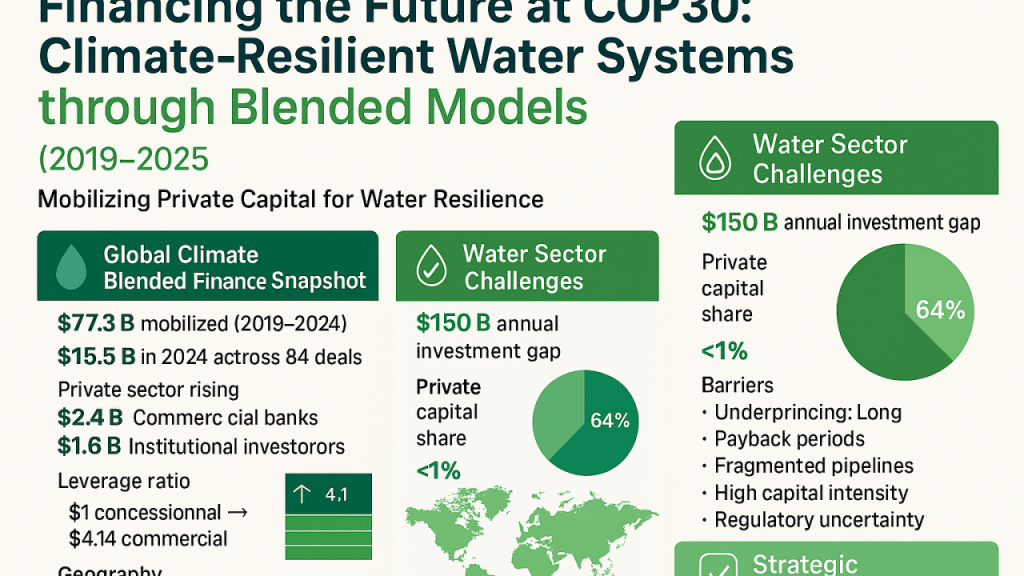

As global climate finance efforts intensify in the COP30, blended finance has emerged as a pivotal mechanism for mobilizing private capital toward climate-resilient infrastructure. Between 2019 and 2024, climate blended finance mobilized over $77 billion globally, with $15.5 billion deployed in 2024 alone. Efficiency gains are evident that each concessional dollar now attracts $4.14 in commercial investment, and institutional investor participation has surged. However, the scale remains insufficient to meet the trillions required annually for climate adaptation and mitigation in developing economies.

The water sector, central to both climate resilience and sustainable development, faces a persistent annual investment gap of over $150 billion. We all agree its critical role but in practice private capital accounts for less than 1% of water infrastructure funding. Barriers include underpricing of water services, long payback periods, fragmented project pipelines, consessional finance or fit for purpose finance, and high capital intensity. These challenges are particularly acute in least developed countries, where blended finance activity has declined, underscoring the need for targeted concessional support and enabling policy reforms.

Blended finance offers tailored solutions to these challenges through instruments such as concessional loans, guarantees, grants, equity, and public-private partnerships. The Green Climate Fund has played a catalytic role, mobilizing over $3.5 billion across 80+ water projects. Successful initiatives such as such as the Amazon Basin transboundary water program, Glacier to farm (G2F), IFC Water Investment Facilities, South Africa’s national water reuse PPP, and Barbados’ debt-for-climate swap, etc demonstrate how fit-for-purpose blended models can unlock sustainable, resilient water investments at scale.

These models align closely with COP30 priorities, particularly the push for nature-based solutions, regional cooperation, and climate-smart infrastructure. GCF-supported projects integrate climate rationale, risk based decision making, IWRM, gender inclusion, and ecosystem co-benefits, making them attractive to both public and private investors. As COP30 continuing in Belém, Brazil, the water sector presents a compelling opportunity to scale blended finance through standardized structures, local capital mobilization, and integrated planning.

To finance the future, stakeholders must treat water as an investable asset class, strengthen project preparation, and expand the use of blended instruments. COP30 discussions should prioritize replicable models that deliver both climate resilience and financial viability. With the right mix of concessional support, policy innovation, and investor engagement, blended finance can transform water security from a global challenge into a scalable investment opportunity.

Water for Climate Pavilion , 2030 Water Resources Group Global Water Intelligence (GWI) Global Water Summit COP30 Brazil

#COP30 #ClimateFinance #BlendedFinance #WaterSecurity #ResilientWaterSystems #WaterForClimate #SDG6 #InvestInWater #ClimateResilience #PublicPrivatePartnerships #GreenClimateFund #NatureBasedSolutions #ClimateSmartInfrastructure #FinancingTheFuture #DisasterRiskReduction #EW4ALL