We are in an era of systemic, interconnected, and cascading climate risks. Tropical cyclones, floods, droughts, and heatwaves are intensifying in both frequency and severity. The cost of inaction is rising exponentially, and our current financing models are not keeping pace. This is a humanitarian crisis and fundamentally a market failure, manifesting as failures in infrastructure, finance, governance, and data that leave billions of people vulnerable. Between 1998 and 2023, climate-related disasters caused over 1.3 million deaths and $3 trillion in economic losses globally. The cost of inaction is rising exponentially, with annual disaster-related losses now estimated to exceed $2.3 trillion when indirect impacts are included.

Early Warning Systems (EWS) is one of the most cost-effective climate adaptation tools remain underfunded and fragmented. Only half of countries globally have adequate multi-hazard EWS coverage. Vulnerable regions such as Eastern Europe and Central Asia have coverage rates as low as 35%. The status quo financing approach has failed to deliver EWS for all. And the stakes are rising: as climate extremes grow, this gap feeds an “unsupportable humanitarian response” cycle – ever-increasing disaster relief costs, economic losses, and debt for hard-hit countries. It’s a vicious circle we must break.

EWS represent a classic market failure but still cost-effectives:

- Public Good Nature: EWS yield high social returns but limited financial returns.

- Capital Intensity: Infrastructure (radars, sensors, ICT) and operations (forecasting, maintenance) require sustained investment.

- Limited Monetization: Benefits (lives saved, economic losses avoided) are not easily monetized.

- Fragmented Governance: Uncoordinated interventions reduce effectiveness.

- Disproportionate Burden: Low-income countries bear the highest disaster risks but have the least fiscal space.

- World Bank & UNDRR: Every $1 invested in EWS yields up to $10 in avoided losses.

- Fakhruddin et al. (Samoa): $1 investment in cyclone warning yielded $6 in avoided losses.

- Triple Dividends: EWS prevent losses, stimulate economic activity, and deliver social/environmental co-benefits.

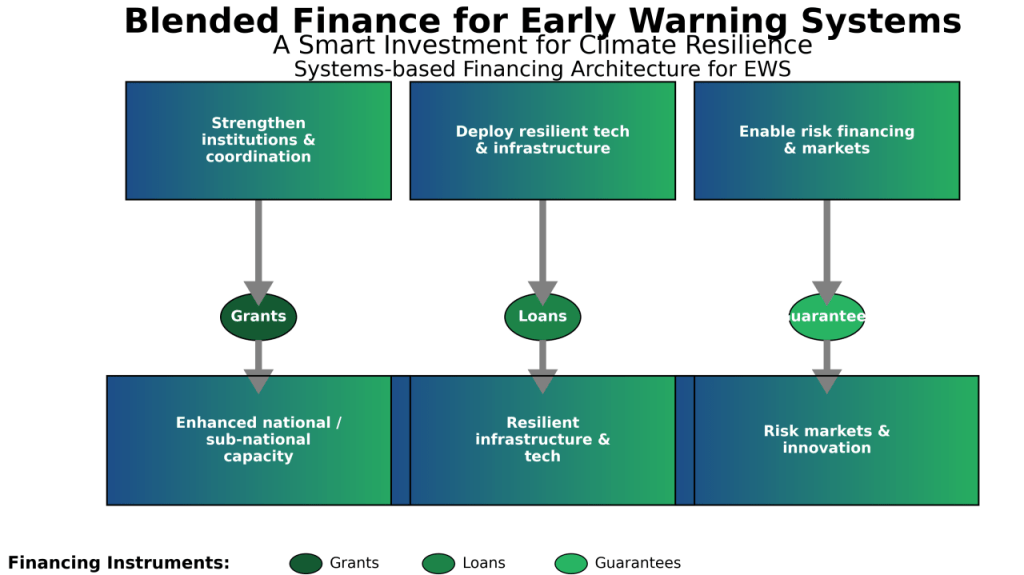

This brings me to the crux: the need for blended finance for Early Warning Systems, to achieve long-term sustainability. Blended finance is about mixing different types of capital such as public, private, multilateral to achieve what none can do alone. It’s the financial embodiment of partnership. In the context of EWS, a blended approach allows us to allocate risks and responsibilities to the parties best suited. It structure EWS projects so that each dollar is used where it has the most impact. Public dollars take on the things the market won’t do (but society desperately needs), and private dollars can then join in where there’s a viable model (such as offering innovative services or products around the public infrastructure). This combination is how we align profit incentives with social good.

Evolving and layered approach could addresses the big barriers:

(i) High risk – mitigated by guarantees and first-loss grant capital.

(ii) Low financial return – acceptable because concessional public investors are mission-driven, and private investors are given enough risk cushion to accept lower returns.

(iii) Difficulty crowding-in finance – solved by the combination of above; once the structure is lower-risk, more financiers (including domestic banks or climate bonds) can join in.

The financing needed to build EWS for all is on the order of $3–5 billion in the next five years (as estimated by WMO), and to maintain them perhaps a similar amount per year globally. Compared to the trillions in disaster losses, this is a bargain. Yet current funding for EWS is fragmented and insufficient. A recent UNDRR/WMO analysis (Global Observatory for EWS Investments) shows inequalities in funding distributions, and many high-risk nations receive little to none. This mismatch must be corrected by directing resources to where needs are greatest. Humanitarian aid, which is what kicks in after a disaster, has ballooned over the past decade (climate-related disasters now routinely cause $100+ billion in annual humanitarian response needs). But less than 4% of disaster-related aid goes into prevention and preparedness. That is like treating the symptoms and neglecting the cure. We need donors and MDBs to pivot from reaction to prevention, and EWS is the front line of prevention.

The climate crisis demands that we break out of silos – between humanitarian and development funding, between public and private sectors, between national and international efforts. Early Warning Systems epitomize this need for integration: they connect science with society, technology with tradition, markets with public goods. Financing these systems must mirror that integration. Blended finance is how we connect the dots.

#ClimateResilience #EarlyWarningForAll #AdaptationFinance #ClimateAdaptation #DisasterRiskReduction #SendaiFramework #BlendedFinance #SmartInvestment #ClimateFinance #ResilienceInvestable #PublicPrivatePartnership #DeRiskingClimate #EarlyWarningSystems #ClimateInformationServices #ForecastingInfrastructure #DigitalResilience #TechForClimate #EW4All #Water4All