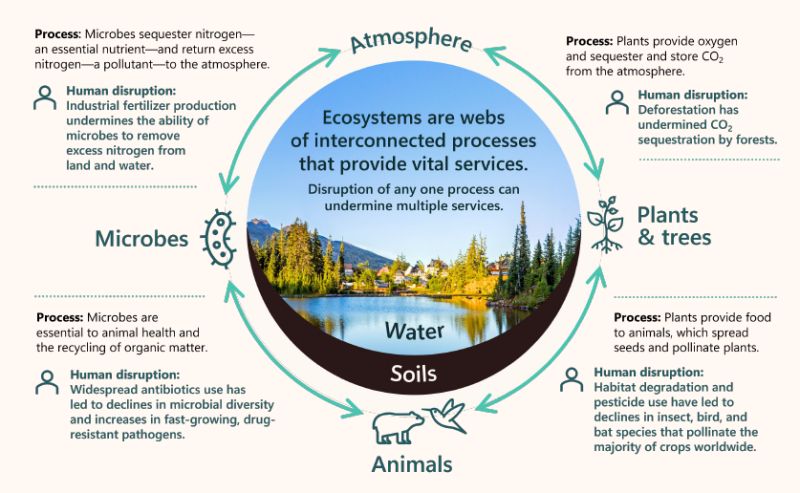

The world is facing a convergence of crises, including accelerating climate change, unprecedented biodiversity loss, and the degradation of ecosystems that are the foundation of life on Earth. However, nature-based solutions offer a path forward, as they are central to achieving climate goals, ensuring water security, and preserving the richness of life on our planet.

Recent assessments show that by 2050, we will need to invest over half a trillion dollars annually in nature-based solutions, more than four times our current expenditure. This is crucial, as half of the world’s GDP is moderately or highly dependent on nature, and 75% of global crops rely on animal pollination. The degradation of ecosystems threatens biodiversity and undermines the economic systems we depend on.

To address this financing gap, innovative financial mechanisms that bring together public and private resources, such as blended finance, emerge as a powerful tool. Blended finance uses catalytic public or philanthropic capital to attract private sector investment into sustainable development, de-risking projects and enhancing returns to incentivize private investors.

Green Climate Fund, with nearly half of its portfolio benefiting nature, has been instrumental in designing innovative financial mechanisms and catalyzing significant private investment. The Amazon Bioeconomy Fund, which blends grants, equity, and loans to support sustainable businesses in the Amazon Basin, nurturing enterprises that protect ecosystems while providing economic opportunities for local communities. Debt-for-nature swaps, where countries burdened with debt partner with creditors to redirect debt repayments towards conservation efforts, alleviating financial stress and channeling resources into ecosystem protection.

To mainstream blended finance for nature-based solutions, concerted efforts are required on several fronts, including:

– Developing policy and regulatory frameworks that incentivize sustainable investments and penalize activities that harm nature.

– Establishing standardization and transparency to build confidence among investors and ensure accountability.

– Investing in the capacities of local communities, governments, and financial institutions to design, implement, and monitor nature-based projects effectively.

– Leveraging technology, such as data analytics, artificial intelligence, and remote sensing, to enhance project design and monitoring, improving efficiency and impact.

Investing in nature is not a cost but an investment in our collective future. By harnessing the ingenuity and resources of the private sector, guided by the vision and oversight of public institutions, we can deliver solutions that are financially viable, socially equitable, and ecologically sustainable. Committing to making blended finance work for nature-based solutions at #COP16 can pave the way towards a sustainable future where nature and humanity prosper in harmony.

#NatureBasedSolutions #BlendedFinance #ClimateAction #SustainableDevelopment #GreenInvestment #Biodiversity #EcosystemProtection #ClimateFinance #COP16 #PrivateSectorEngagement