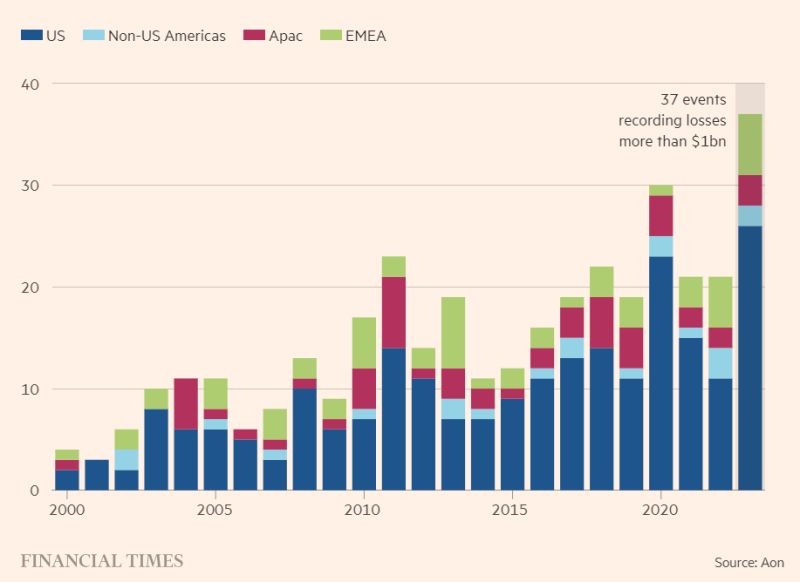

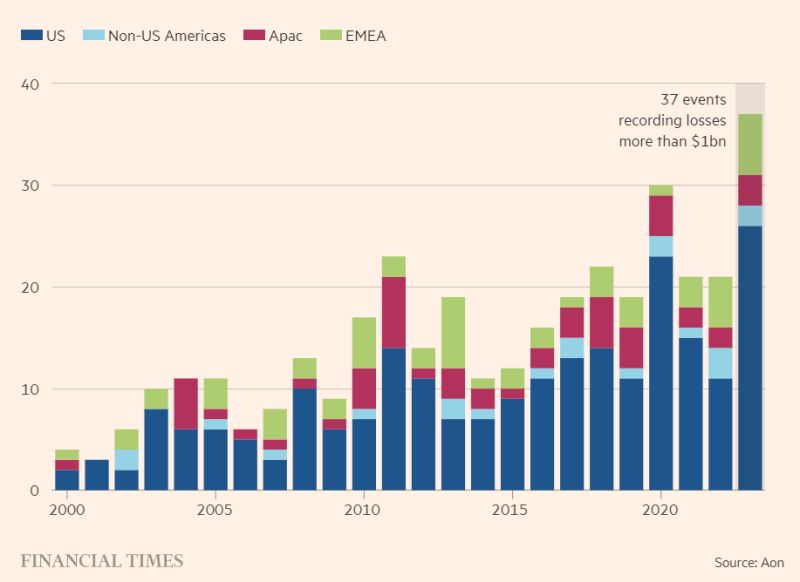

In recent years, there has been a significant increase in natural disasters, resulting in substantial financial losses exceeding $100 billion for four consecutive years. Even in 2023, which was considered a relatively quiet year for tropical storms, there were a record-breaking 37 events, each costing at least $1 billion in losses. This situation raises concerns about the role of the insurance industry in managing and mitigating such losses, as well as the sustainability of the traditional insurance model to a transformative model.

The insurance industry’s outdated risk assessment models may have failed to keep pace with the accelerating impacts of climate change. The reliance on historical data and the short-term nature of insurance policies have led to an underestimation of the risks posed by extreme weather events. As a result, insurers have been forced to raise premiums, reduce coverage, or withdraw from high-risk areas altogether, leaving vulnerable communities in need of more protection. This approach is not sustainable in the long run.

By integrating climate risk considerations into their underwriting and investment strategies and using innovative financing, insurers can incentivize companies to adopt more sustainable practices and accelerate the transition to a low-carbon economy. The threat of an “uninsurable world” caused by climate change is a stark reminder of the urgent need for action. The insurance industry must adapt and evolve to meet the challenges of our changing climate, embracing a long-term, collaborative, and sustainable approach.