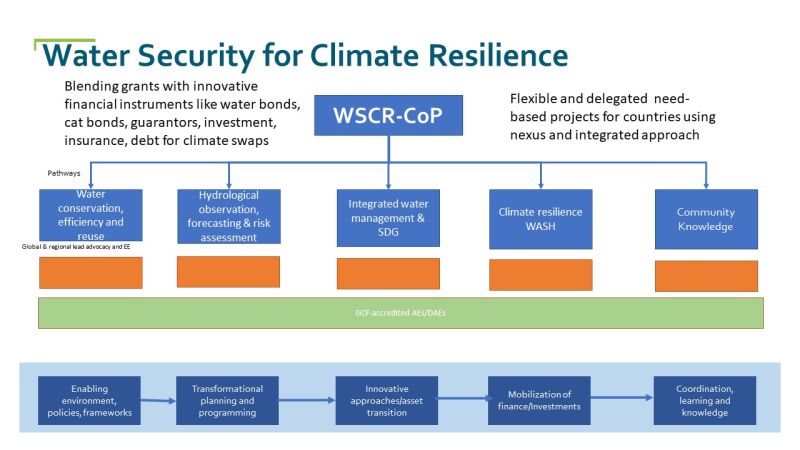

Financing is key to realizing this vision. We must align investments for water security with climate action and find innovative ways to mobilize new sources of funding. Blended finance instruments that strategically combine public and private capital can accelerate the deployment of climate solutions. Mechanisms like resilience bonds, environmental impact bonds, and blue carbon offset markets can help manage risk and generate revenues for sustainable water projects.

Climate and development finance institutions must ramp up support and create dedicated water security and resilience funding streams. Advanced technologies, from AI to new modeling tools, can support climate risk-informed investments and resilient water planning. Governments have a responsibility to mainstream climate across budgets and regulatory frameworks, providing the enabling conditions for sustainable finance.

The business case for these solutions is clear. Studies estimate a $1 trillion market opportunity for climate-smart urban water investments alone over the next decade. Forward-looking institutions are already pioneering innovative models to tap into this immense potential.

But we need to accelerate and scale up these efforts dramatically. We must facilitate action coalitions between governments, businesses, investors, and local stakeholders. Partnerships and sharing of expertise will be vital. Developed countries must also fulfill their climate finance commitments to the developing world.

Bapon (SHM) Fakhruddin, PhD

Water and Climate Leader| Strategic Investment Partnerships and Co-Investments| Professor| EW4ALL| Board Member| Chair- CODATA TG| Award Winner (SDG 2021, EWS 2025)